Different from the price war in the domestic market, some foreign brands are raising the price of equipment in other parts of the world. "Two Heavens of Ice and Fire" is not only applicable to the sales trend of domestic and foreign construction machinery markets, but also the price.

In mid-to-late October, Komatsu publicly announced that it plans to increase prices by about 100 billion yen in fiscal year 2022 (as of March 2023) in order to further absorb the increase in raw material and logistics prices and speed up the transfer of costs. If the price increase of Komatsu can be realized as scheduled, the price will rise by about 4%.

Komatsu's price increase this time is slightly higher than Hitachi Construction Machinery's 3% rate, and Hitachi Construction Machinery is expected to increase its price by 30 billion yen.

Caterpillar's price increase was earlier and larger, and it will start to increase its price in 2021. According to media reports, its price increase from April to June 2022 will bring about US$1.1 billion (about 164.9 billion yen) in revenue. ), accounting for 8% of sales.

In addition, the Wacker Neuson Group has also made several price adjustments to products sold globally since 2022, with an average price increase of 7.2% from August 1, 2022.

In the field of aerial work platforms, JLG and Genie also cover the cost increase through price increases.

The price increase is to transfer the rising manufacturing cost. Behind the cost increase is the increase in raw material prices, supply chain shortages and labor shortages (price increases). But sometimes the price increase cannot fully cover the cost increase. For example, JLG has increased the price by 6.6%, and the cost has increased by 13.4%.

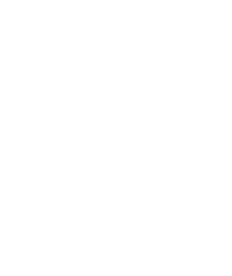

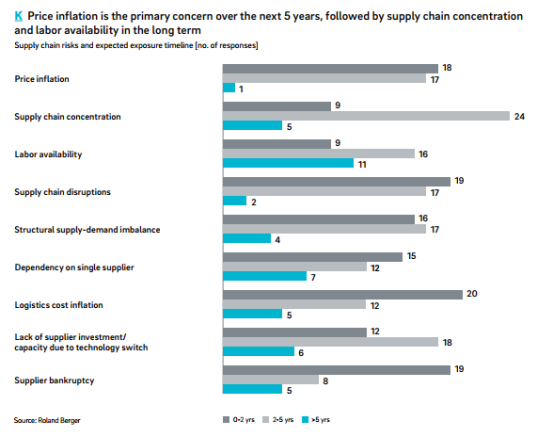

According to the survey results of the white paper "How component shortages are changing the construction equipment industry" (hereinafter referred to as "white paper") recently launched by Off-highway Research and Roland Berger, price increases, supply shortages and labor shortages are the most concerned.

Consumers, businesses and governments face further uncertainty as inflation has become a global phenomenon due to structural supply chain risks and labor issues, the report noted. Supply chain uncertainty is likely to persist as inflationary pressures persist and different regions respond differently.

(Research object: more than 40 companies including OEM, suppliers and aftermarket, with revenue ranging from US$50 million to US$1 billion+)

Gilbane Building Company's latest market report came to a similar conclusion, and while a slowdown in demand impacted construction equipment and material prices in the last quarter (Q3 2022), volatility is likely to persist.

Changes in main raw materials

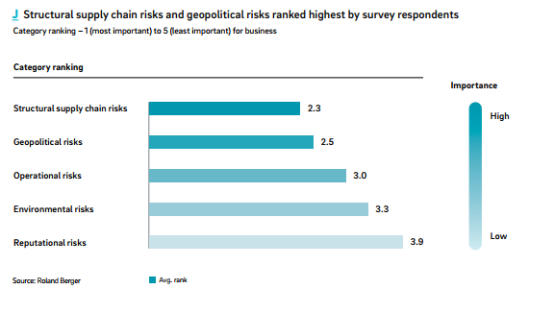

Prices for diesel, asphalt, lumber and some metals changed in July, the report showed. At the same time, prices for concrete products and some building materials continued to climb. Some equipment and materials did reduce lead times, while others remained challenging. Looking ahead, materials used in construction equipment, including semiconductors, electrical steel, construction sand, cement/concrete and even glass, will continue to face supply constraints and shortages.

Caterpillar also warned in its second quarter performance report for 2022 that the problem of tight global supply chains will continue.

Delivery time of different products (delivery time of mechanical equipment is about 8-12 months)

On the one hand, factors such as the continuation of geopolitical conflicts, market uncertainty about the adjustment of the Federal Reserve's monetary policy, (US West) port labor negotiations, traffic disruptions, and epidemic blockades continue to affect the cost and availability of equipment and materials at both ends of the supply and demand. And once inflation peaks, unlocking the cost globally will be a slow process.

On the other hand, the labor shortage caused by the aging population has led to rising labor costs, while the labor supply is still weak, and workers will continue to hold the initiative in wage negotiations. The data shows that in 2022 (USA), the national average wage increase will reach 5.7%.

An aging construction workforce, rising labor costs and a growing focus on safety are also creating demand for smaller equipment and automation, while supply chain issues are causing shortages.

(The results of the white paper survey show that price increases in the next five years are the primary issue, followed by supply chain and labor issues)

As far as the North American market is concerned, although the $1.2 trillion Infrastructure Investment and Jobs Act will bring many benefits, it will also put greater pressure on the supply of materials and labor.

For equipment manufacturers, everyone faces the problem of rising costs brought about by tight supply chains and labor shortages, but they are also beneficiaries, including Chinese brands that are currently growing in the export market. According to public information, JLG's backlog of orders is as high as 3.97 billion US dollars (can be produced for one year), and Sany Heavy Industry's overseas orders are also scheduled until 2023.

In order to solve the supply chain problems, some foreign brands once again set their sights on the unique Chinese market. In the case of repeated decline in market share, it did not exit the market. On the contrary, it further increased capital and expanded production, and increased industrial investment and layout in China. The complete supply chain and cost advantages of the Chinese market are still there, and the strategy is simply shifted from product to manufacturing to create a global production base that fully covers the complete machine and components and the upstream and downstream industrial chains, relying on China's complete industrial system to radiate Global Market.

As for domestic brands going global, among the elements supporting export growth at this stage, competitive prices, a complete industrial system, and abundant production capacity are among them. Right now, the tense supply chain period in overseas markets provides a window period for domestic enterprises to go overseas, but whether they can grasp this window period must not rely solely on price and cost performance, especially in mature markets such as Europe and the United States, because there, the same tonnage For large-scale excavators and loaders, the prices of Caterpillar and John Deere can be 2 to 3 times that of domestic brands. Even if they are currently in the price increase stage, they have not affected their market share.